capital gains tax changes 2020

HM Revenue Customs. What is a CGT event.

Can Capital Gains Push Me Into A Higher Tax Bracket

How much you earn in total.

. Dividends distributed within taxable periods commencing after 1 January 2020 arising from entities operating under the legal form of Société Anonyme or Limited Liability are. This percentage will generally be less than your income. Tax Season 2021 has begun.

Your overall earnings determine how much of your capital gains are taxed at 10 or 20. Although it is referred to as capital gains tax it is. What type of assets you sell.

Companies especially with tax-sensitive customers react to capital gains tax and its change. The long-term capital gains tax rates are 0 percent 15 percent and 20 percent depending on your income. Capital gains tax CGT is the tax you pay on profits from selling assets such as property.

Before you start your federal tax return know the changes in key IRS forms that affect you. Because capital gains got handled differently than ordinary income under the tax law changes. Your total capital gains tax CGT owed depends on two main components.

Long-term capital gains tax is a tax applied to assets held for more than a year. The deadlines for paying Capital Gains Tax after selling a residential property in the UK are changing from 6 April 2020 - understand the changes and what you need to do. This means no changes can be made to the trust.

Long-term capital gains taxes for 2020 tax year. Because of the Tax Reform for Acceleration and Inclusion TRAIN Law capital gains tax is currently at 15 for individual and domestic corporations effective since January 1 2018. Capital Gains Tax.

You report capital gains and capital losses in your income tax return and pay tax on your capital gains. Long-term capital gains on so-called collectible assets. You can use the same process for figuring out your capital gains tax rate in most.

However if the asset is owned by a company the company is not entitled to any capital gains tax discount and youll pay 30 tax on any net capital gains. The capital gains tax rates in the tables above apply to most assets but there are some noteworthy exceptions. Understanding the tax rules and staying abreast of tax changes can.

UK residential property sold since 6 April 2020. The TRAIN Law is part of the governments project called the Comprehensive Tax Reform Program for the National Internal. The good news is that the tax code allows you to exclude some or all of such a gain from capital gains tax as long as you meet three conditions.

How are capital gains taxed in a trust 2020. As of 2021 the long-term capital gains tax is typically either 0 15 or 20 depending upon your tax bracket. How and when you report Capital Gains Tax over your annual allowance depends on what you made the gain on.

These rates are typically much lower than the ordinary income tax rate. Long Term Capital Gains Tax Rate in 2020 for 180000 15. CGT and its changes affect trading and selling stocks on the market.

15 Rate Applies. Using this formula you will owe 89546 in capital gains taxes in Missouri for the 2020 tax yearTo find your actual amount simply consult the tax table to get the base amount plus the tax rate that applies to the rest of your capital gain. Our capital gains tax rates guide explains this in more detail.

If your family members homes cost basis is 300000 and the current market value is 400000 once the. The 0 rate applies up to 2650. Premier Self-Employed TurboTax Live TurboTax Live Full Service or with PLUS benefits.

CGT event is the date you sell or dispose of an asset. The long-term capital gains tax rates are 0 15 and 20 depending on your income tax bracket. Since 2003 qualified dividends have also been taxed at the lower rates.

The IRS considers assets held for longer than one year to be long-term investments. MAXIMUM TAX RATE ON CAPITAL GAINS. When you dig into your tax return for reporting 2020 income youll.

You can the plug in the numbers to the formula. Our capital gains tax calculator determines the total tax that you will have to pay on the profit or capital gain you earned from selling an asset. In your case where capital gains from shares were 20000 and.

If the grantor was also the trustee it is at this point that the successor trustee steps in. To report any. And for SMSF the tax rate is 15 and the discount is 333 rather than 50 for individuals.

However the Biden administration has proposed changes to how the capital gains tax is. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the. Capital gains tax is due on 50000 300000 profit - 250000 IRS exclusion.

For tax year 2020 the 20 maximum capital gain rate applies to estates and trusts with income above 13150. In 2020 she sold her home for 550000. The maximum long-term capital gains and ordinary income tax rates were equal in 1988 through 1990.

If your taxable income is less than 80000 some or all of your net gain may even be taxed at 0. What Is the Capital Gains Tax for 2020. For most of the history of the income tax long-term capital gains have been taxed at lower rates than ordinary income figure 1.

The capital gains tax on most net gains is no more than 15 for most people.

How High Are Capital Gains Taxes In Your State Tax Foundation

Mutual Funds Taxation Rules Fy 2020 21 Capital Gains Dividends

Mutual Funds Taxation Rules Fy 2020 21 Capital Gains Dividends

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Calculator For Relative Value Investing

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

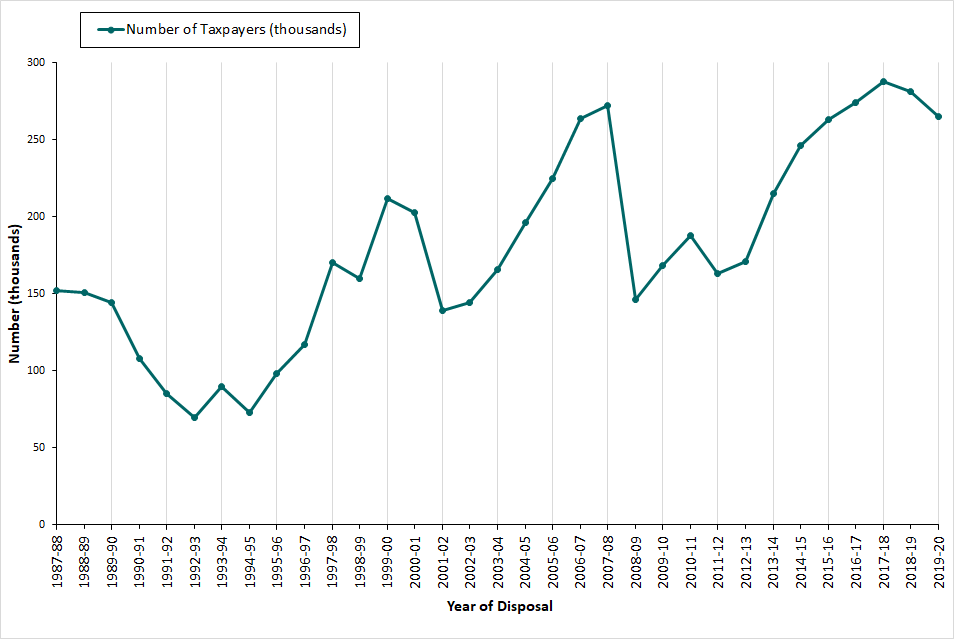

Capital Gains Tax Commentary Gov Uk

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

What You Need To Know About Capital Gains Tax

How To Pay 0 Capital Gains Taxes With A Six Figure Income

What You Need To Know About Capital Gains Tax

What You Need To Know About Capital Gains Tax

Capital Gains Tax Calculator For Relative Value Investing

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Capital Gains Tax Commentary Gov Uk

Short Term And Long Term Capital Gains Tax Rates By Income In 2020 Capital Gains Tax Tax Rate Capital Gain

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)